Federal benefit of state tax is a crucial aspect of the financial landscape that impacts individuals and businesses alike. Understanding the relationship between federal and state taxes is essential for maximizing benefits and minimizing liabilities. Whether you're a taxpayer, a business owner, or a financial professional, grasping the intricacies of this relationship can lead to significant advantages. In this article, we'll delve into the federal benefit of state tax and explore its implications for various stakeholders.

When it comes to taxes, the interplay between federal and state regulations can have a profound impact on your financial well-being. From income tax to sales tax, the way these two levels of government interact can determine the amount you owe or the amount you receive in refunds. By understanding the federal benefit of state tax, you can make informed decisions about where to live, where to do business, and how to structure your finances for optimal outcomes.

Given the complexities of the tax code, it's no surprise that many individuals and businesses are left scratching their heads when it comes to navigating federal and state tax laws. However, with the right knowledge and guidance, you can leverage the federal benefit of state tax to your advantage and ensure that you're not paying more than necessary.

What is the Federal Benefit of State Tax?

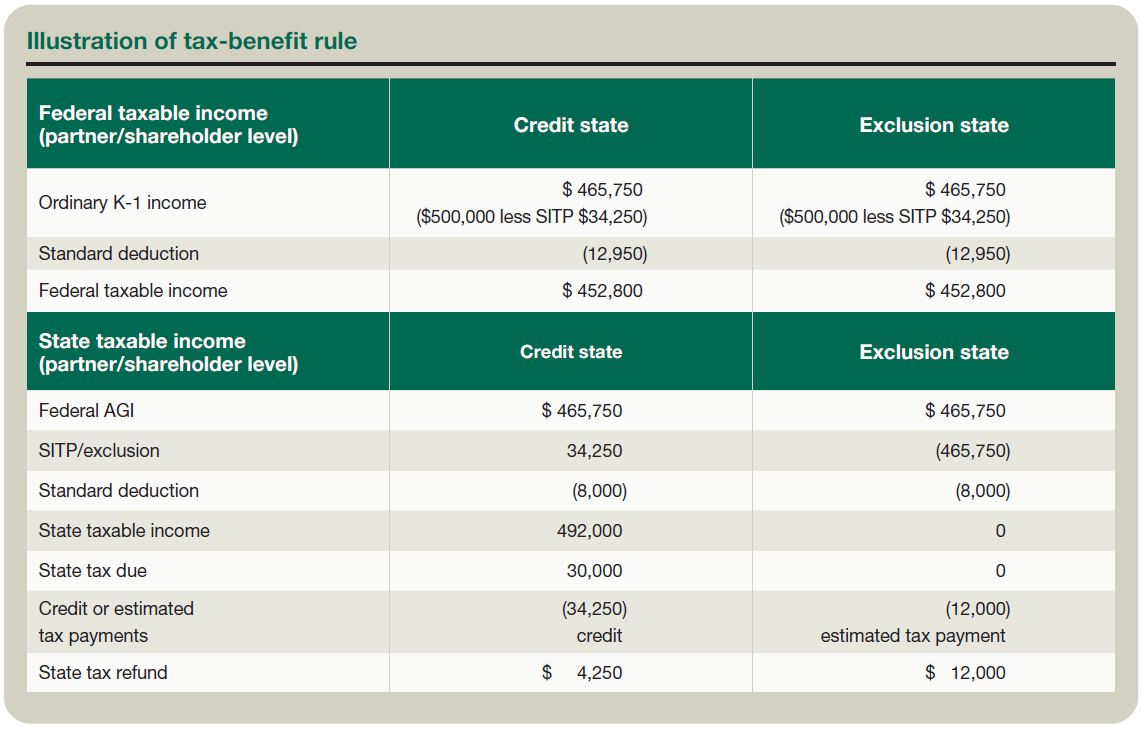

The federal benefit of state tax refers to the advantages that individuals and businesses can gain by taking into account state tax payments when calculating their federal tax liability. Essentially, this concept recognizes that state taxes paid can be deducted from your federal taxable income, thereby reducing the amount of federal tax you owe. This can result in significant savings for taxpayers, especially in states with high income or property taxes.

How Does the Federal Benefit of State Tax Work?

Understanding how the federal benefit of state tax works requires a grasp of the various deductions and credits available at the federal level. By factoring in state tax payments when filing your federal tax return, you can potentially lower your taxable income and, in turn, decrease your federal tax burden. However, the rules governing these deductions can be complex and vary based on individual circumstances and state tax laws. It's essential to consult with a tax professional to ensure that you're maximizing the benefits of this interplay.

Who Can Benefit from the Federal Benefit of State Tax?

Virtually anyone who pays state taxes can potentially benefit from the federal benefit of state tax. Whether you're an individual earning income in a state with high income taxes or a business paying substantial property taxes, understanding how these payments can impact your federal tax liability is crucial. Additionally, certain credits and incentives at the federal level may further enhance the benefits of this interplay, making it even more advantageous for taxpayers.

Maximizing the Federal Benefit of State Tax

To make the most of the federal benefit of state tax, there are several strategies and considerations to keep in mind. From timing your deductions to taking advantage of specific credits, understanding the nuances of this relationship can lead to substantial savings. By working with a knowledgeable tax professional and staying informed about changes to tax laws, you can position yourself to capitalize on the federal benefit of state tax.

Key Considerations for Taxpayers

For individual taxpayers, maximizing the federal benefit of state tax involves careful planning and attention to detail. Keeping thorough records of state tax payments, understanding the rules for deductibility, and exploring potential credits are all essential steps. Additionally, staying abreast of changes to federal and state tax laws can help you adapt your strategy and ensure that you're taking full advantage of available benefits.

Implications for Businesses

Business owners also stand to benefit from the interplay between federal and state taxes. By understanding how state tax payments can impact federal tax liabilities, businesses can optimize their financial position and improve their bottom line. From structuring operations in tax-friendly states to leveraging available credits and incentives, there are numerous opportunities for businesses to capitalize on the federal benefit of state tax.

Conclusion

Understanding the federal benefit of state tax is essential for anyone looking to navigate the complexities of the tax landscape effectively. By grasping the nuances of this relationship and exploring strategies for maximizing benefits, individuals and businesses can position themselves for financial success. Whether it's taking advantage of deductions, leveraging credits, or staying informed about regulatory changes, the federal benefit of state tax offers a wealth of opportunities for those willing to explore them.

Who Is Barry Statham?

Maggie Magaña: A Rising Star In The Entertainment Industry

Javicia Leslie Partner: Who Is She Dating?

ncG1vNJzZmieopq2s8XEp2lnq2NjwrR51p6qrWViY66urdmopZqvo2OwsLmOn5ydnaKWuW6uxKecn6GkYrynedKtmK2dXamuuXrHraSl